The Euro has fallen below the U.S. dollar for the first time in more than two decades, and markets are on edge for more clarity on central banks’ response to the conflicting forces of inflation and recessionary risk. The European Central Bank has signaled that it will increase interest rates quickly, but the currency could suffer from fragmentation risks. The euro is a strong currency in terms of purchasing power, but the dollar is still the dominant currency in international trade.

Euro falls below U.S. dollar in value for first time in 20 years

The euro’s fall came as investors fretted over escalating oil prices in Europe and fears that this would trigger an economic slowdown. As a result, the European Central Bank (ECB) was slower than its peers to increase interest rates, a crucial factor in currency value. Meanwhile, Russia is slowly cutting off its fuel supplies to western Europe in retaliation for sanctions. Additionally, war in Ukraine has created a great deal of instability in the region, which may push more investors to dump their euros for dollars.

While the euro has been resilient and strong as a currency, its union is still a weaker currency. Despite these concerns, central bankers have not significantly tested their commitment to preserving the euro. It also adds to inflationary pressures in the region, increasing the cost of imported goods. The ECB can’t stop the euro’s fall with words alone, however.

The currency pair has fallen to its lowest level in more than 20 years due to deep fears about the global economy. Meanwhile, a war in Ukraine threatens the currency bloc’s growth prospects and a war in eastern Ukraine could spark a global recession. As a result, the dollar is now worth more than its European counterpart. With the euro falling, investors are becoming increasingly nervous about the future.

The fall of the euro against the dollar could help European companies, especially ahead of second-quarter earnings season. According to Morgan Stanley’s chief European equity strategist, this could boost corporate profits. Analysts expect second-quarter earnings to end in a net beat this year. So what happens now? Should a recession hit the eurozone? It depends on what happens next, but for now, the fall is a good thing for Americans traveling to Europe this summer.

- Also Read: Brian Stelter Sources Reliable Complete Details!

- Also Read: Is Swimsecure Legit? Authentic Details!

- Also Read: Is Omf com Offer Legit? Authentic Details!

After a long period of high inflation, the European Union’s economy has been struggling. Rising energy prices and the war in Ukraine are putting pressure on supply chains across the continent. The European Union receives 40% of its gas through Russian pipelines prior to the war. However, as Russia ramps up its military presence in Ukraine, it has already slowed its gas supplies to some EU countries, including Germany. Furthermore, the Nord Stream pipeline was shut down for 10 days this month, reducing the flow to Germany.

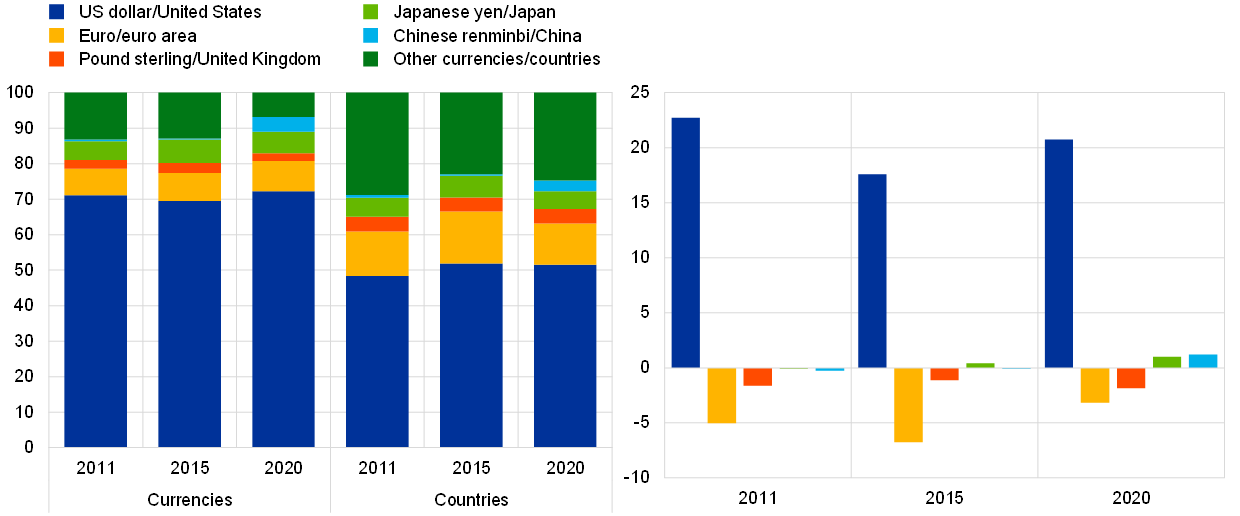

The US dollar has remained strong in recent months, which has helped the euro fall against other currencies. The rise in the dollar has encouraged investors to chase dollars because they offer higher returns than other currencies. Meanwhile, the European Central Bank is expected to raise interest rates later this month. The US dollar has a unique role in the world economy, as the dominant reserve currency. Countries around the world keep large amounts of dollars in reserve to cover their economic needs.

Markets on alert for more clarity over central bank responses to conflicting forces of recessionary risks and soaring prices

Investors remain on alert for more clarity over central bank responses as they consider the economic outlook. There is a growing concern that the Fed may have to quickly adjust policy rates in order to curb inflationary pressures. This may complicate the situation and lead to market volatility. As a result, investors should focus on diversification and quality when investing in stocks. The broader market is in a defensive mode, and investors should consider adding to their portfolios with stocks of profitable companies.

The ECB’s balance sheet expansion will continue to hurt long-term yields for the foreseeable future, until it starts unwinding its balance sheet. The main concern for many countries is the continuing rise in prices and recessionary risks. Rising interest rates will constrain consumer spending and destabilize the global economy. This could push the U.S. and Europe into recession by the year 2023.

Inflation is a major cause of market volatility. May’s Consumer Price Index (CPI) rose 8.6% in May, prompting selling of stocks by investors hoping for a sign of a consumer price peak. On Monday, the S&P 500 plunged into bear market territory, down more than 20% from its highs in January 2021. The Fed’s latest report, titled “Capital Market Outlook”, offers more insight into the future path of inflation and the economy.

- Also Read: Terrorism Charges Against Former Prime Minister Imran Khan Read Details!

- Also Read: Is Styleprint Legit? Authentic Details!

- Also Read: Medusa Tattoo Meaning – The Legend of Medusa TikTok tattoo trend explained!

The rising cost of raw materials and higher interest rates have put the Asia-Pacific economy at risk of a slowdown. Increasing input costs have also pushed up borrowing costs, which erodes firm margins and consumer purchasing power. Meanwhile, heightened volatility in global markets has exacerbated risk aversion among banks, driving tighter refinancing for lower rated borrowers. This exacerbates the risk of a slower recovery in China.

Inflation is a key factor in determining monetary policy. Rising inflation is one of the main reasons why the Fed has raised rates. A higher rate would require the Fed to tighten policy significantly from its current levels. If the inflationary risks of the economy are severe enough, the Fed could also halt rate hikes to calm the market.

While investors have benefited from favorable financing conditions for the past couple of years, they are now concerned that these favorable conditions are about to end. Rising interest rates and persistent inflation would push the U.S. economy into recession. However, even a slight slowdown in the economy could destabilize the credit markets. A further slowdown could result in repricing of assets and higher debt-servicing costs. Consequently, profit erosion could become more widespread than expected.

As the economic outlook becomes more uncertain, the central banks must continue to address the problem of oil prices. Crude oil prices fell during the Asian financial crisis in late 1998, but soon after, energy prices rose to their highest levels since the Gulf War. At the time, monetary policy makers had acted to prevent overheating and avoid the effects of high energy prices. In the past, the rise of energy prices was preceded by a high oil price, and this trend appears to be repeated today.

Markets could be hurt by fragmentation risks

Fragmentation is a potential threat to markets. As more people become involved in cryptocurrency trading, the risk of price fragmentation will increase. This phenomenon could hurt liquidity. If cryptocurrencies are exposed to too much transparency, holders may be afraid of adverse price movements. As a result, volumes could migrate to off-exchange venues. Fragmentation can cause a cascade of problems for markets. Markets are already vulnerable to this threat, but if it gets out of control, it could harm the economy.

ECB officials say that excessive fragmentation risks can impede efficient transmission of monetary policy. Fragmentation risk is especially problematic in the Eurozone, where weaker countries may face higher refinancing costs. The ECB’s own monetary policy mandate, which has been to promote price stability, also increases the risk of market fragmentation. To avoid this risk, the ECB can introduce measures to reduce fragmentation risks while still maintaining a constructive ambiguity. But these measures must be designed to not hamper the pace of policy normalization.

The extent of fragmentation does not directly correlate with spreads. However, it is possible that market structure could be improved in some areas. According to a recent survey, 65 percent of respondents said a consolidated tape in the European equity markets would be beneficial. Fragmentation also makes accessing multiple sources of data and liquidity more expensive. While this may not have a direct correlation with volatility, it does suggest that market fragmentation is a risk.

While average bid-ask spreads have fallen since the introduction of MiFID, a fragmented market could lead to a decline in liquidity. Fragmentation increases market volatility. This has been seen in recent years. However, the impact of these risks is yet to be felt. As a result, a study from the University of Cambridge found that the cost of trading in the U.K. is the most fragmented market in Europe.

Fragmented market structure can affect liquidity, transparency, and efficiency of price formation. Fragmentation risks can cause costs and uncertainty for investors, and the lack of clarity among market participants. Furthermore, the fragmentation of trade data can also affect price formation, reducing the efficiency of market operations. This has a major impact on market transparency and efficiency. A study of the fragmented market structure also shows that it has not significantly affected the interaction of orders among market participants.

The euro exchanged at a two-decade low of 0.9903 against the U.S. dollar Tuesday morning, with experts anticipating the single money will keep on sliding.

“Our viewpoint and our exchanges and our situation on the specialist side are certainly one-sided towards additional euro devaluation from where we are presently,” Luis Costa, head of CEEMEA technique at Citibank, told CNBC’s “Screech Box Europe” on Tuesday.

“This is the essential place of euro weakness now,” Costa said.

There are various elements having an effect on everything while looking at the euro and the dollar, working couple with the continuous clash in Ukraine and mounting expansion across the two locales.

Discount gas costs in Europe rose pointedly on Monday after Russia reported unscheduled support on its principal pipeline to Germany, Nord Stream 1, while heat waves have overburdened energy supplies.

For the full picture, you additionally need to look past Europe and the United States, says Costa.

“We should not fail to remember there is an extra layer of intricacy here from the China lull which clearly hits Europe with a lot higher greatness when contrasted with the effect in the States,” he said.

- Also Read: Fifa 23 Edition Ultimate Pre-Purchase and Pre-Order, Release Date!

- Also Read: Avenue Avebury Tonbridge Stabbing Case How Many People were Arrested?

China missed GDP assumptions with development of only 0.4% in the subsequent quarter. The world second-biggest economy has battled with the fallout of the nation’s most exceedingly terrible Covid-19 episode starting from the beginning of 2020.

Until May, markets were “taking into account hawkish flight ways” for the European Central Bank and the Bank of England, as per Costa, however those plans have “collapsed” lately.

“Discussing ECB takeoff… It’s totally glaring that ECB space to lift rates will be insignificant,” he said.

Worldwide money foundation ING’s Roelof-Jan Van nook Akker made comparable forecasts on CNBC’s “Cackle Box Europe” last week, recommending an enlarging in the financing cost differential between the U.S. dollar and the euro, as well as a further debilitating of the single money.

″[The dollar] broke underneath the 103.60 help level. That is an extremely vital level help … And I recommend that there’s additional drawback potential to go. Longer-term focus of between $0.80 to $0.75 before long,” Van sanctum Akker said.

“It affirms there is dollar strength as well as euro shortcoming,” he told CNBC.

The forecasts reverberation worries that expansion will proceed to rise and that a downturn in Europe is presently undeniable.

The dollar’s solidarity may not stand the test of time however, as per Societe Generale Macro Strategist Kit Juckes.

“Perhaps, all things considered, the dollar rally has run comparably far as it can on the ongoing news,” he wrote in an email Tuesday morning.

“Saying this doesn’t imply that Europe’s energy burdens, China’s financial shortcoming and strategy facilitating, and US occupations/expansion information can’t send it further, yet when I read that purchasing the dollar is ‘the least demanding exchange FX’ the hairs on the rear of my neck caution me to be cautious,” Juckes composed.

Furthermore, Europe ought to have the option to recuperate from those “troubles,” as per the tactician.

“I actually can’t understand how it can revitalize a lot of on something besides short covering, yet in the event that hazard markets don’t meddle, the euro can view as a base here,” he composed.