Inflation Reduction Act cleared House on Friday after 18 months in the making. While Republicans remained steadfast in opposition, Democrats hail the legislation as a victory and call it life-changing. Among Democrats, House Speaker Nancy Pelosi said it was a win for the middle class and families. The legislation would reduce the deficit by more than $300 billion and improve the economy for American families. While it’s important to note that the bill passed only with Democratic votes, the final vote is expected to be in the Senate.

- Also Read: Soltea Reviews Is Soltea Right For You?

Manchin voted “no” on Inflation Reduction Act

Sen. Joe Manchin of West Virginia is a proponent of the Inflation Reduction Act. It would dedicate hundreds of billions of dollars to reduce the deficit, protect small businesses, and make sure the wealthy pay their fair share in taxes. However, his vote against the bill was not unanimous. The measure passed the Senate 51-50 and is now moving to the House, where it could be voted on later this week.

The Inflation Reduction Act, meanwhile, would have closed a loophole that allows money managers to avoid paying taxes on their income. The loophole allows money managers to pay lower tax rates than other professions. While the average income tax rate is 37 percent, money managers’ income is taxed at only 28 percent. Closing the loophole is a key objective of Manchin’s, which is part of reducing the deficit.

The Inflation Reduction Act is a comprehensive plan for cutting the country’s costs. It will pay down the national debt and lower healthcare and energy prices. Democratic leaders have made it clear that they are committed to passing the Inflation Reduction Act, which would be signed into law by the president in 2022. The bill is backed by the Democratic leadership and Senate Majority Leader Chuck Schumer. The Democrats want to push through this economic plan, which includes tax policy reforms, climate change policy, and health care reform. Manchin was the most vocal holdout when the original Build Back Better legislation was introduced.

After passing the House, the Inflation Reduction Act will now head to President Joe Biden for his signature. Biden has indicated that he will sign the bill. If signed into law, the Inflation Reduction Act will make a significant investment in the United States’ economy, deliver millions of health care subsidies, and enact a minimum tax of 15% on corporations. This bill is a good step towards reducing the country’s debt and tackling the growing climate crisis.

Democrats pass bill to tackle deficit, health care, climate change

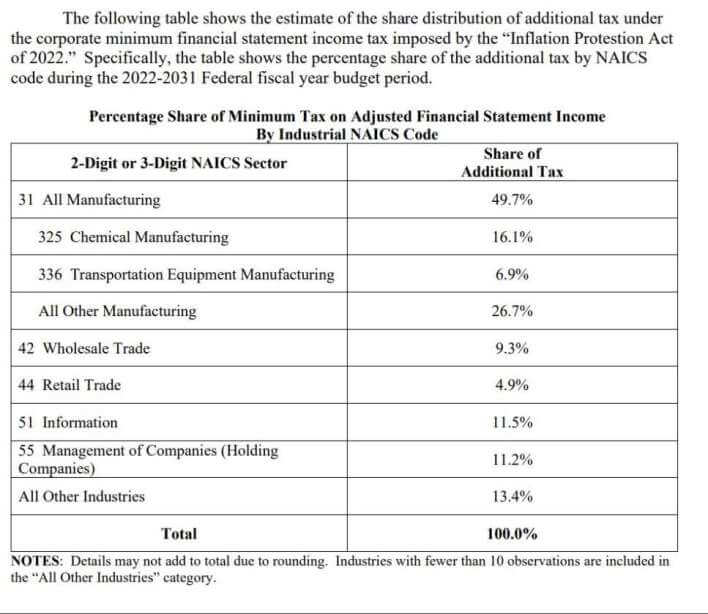

Senate Democrats have passed a massive bill that addresses debt, health care, and climate change. The bill includes a new corporate minimum tax, an expansion of Medicare’s out-of-pocket drug costs cap, and other measures to combat the effects of climate change and deficit. The bill may not immediately tame inflationary price hikes, but the Democratic-led Congress has made a bold step in the right direction.

The bipartisan bill crafted by Schumer and Manchin last week reduces prescription drug costs, extends the Obamacare subsidies, and invests $370 billion over 10 years to combat climate change and improve energy production. The bill also pays down the federal deficit by nearly $300 billion. Some of the bill’s climate benefits include a seven-thousand-dollar tax credit for new electric cars, a thirty-percent tax credit for big clean energy projects, and a $7500 tax credit for electric vehicles. But those benefits are largely a matter of debate and may be weakened during the debate, so it is important to watch closely and understand what the bill offers.

- Also Read: Gravity Defyer Reviews Complete Details!

Senate Republicans targeted vulnerable Democrats in re-election campaigns this year in an effort to block the legislation. GOP leader Mitch McConnell named four Democratic senators in tight races as the targets of Republican attacks. The bill was 18 months in the making. Despite numerous obstacles, Biden’s original Build Back Better plan was largely defeated in the Senate. In addition to Republicans, Biden’s proposal was also opposed by key Democratic lawmakers.

The Senate voted 51-50 to pass the tax-cut, health-care, and climate change legislation. The final vote was broken by Vice President Kamala Harris and broke a tie. Despite the difficulties of passing the bill, it remains a huge step forward for the Democrat Party and its presidential candidates. The House is expected to take up the legislation on Friday. It will make the Democrats more competitive in the upcoming midterm elections.

Republicans have criticized the bill for not addressing inflation and have said the bill is nothing more than a left-wing spending wish list. However, most Democrats say it will help combat inflation and the bill’s passage is unlikely to have a significant impact on the economy in the coming months. Either way, it’s unlikely to be overturned in the short run. So, what happens next?

Despite its flaws, the new bill still offers a large stimulus package for the economy. The bill will contain $440 billion in new spending and $300 billion in cuts to deficits. The bill will empower the Medicare secretary to negotiate drug prices with pharmaceutical companies on behalf of beneficiaries, which could save $288 billion over 10 years. This could cut the cost of prescription drugs for seniors, while providing them with free vaccinations.

Measure would reduce deficit by more than $300 billion

The Inflation Reduction Act of 2022 passed the Senate on Aug. 7. The bill would tackle climate change, reduce the deficit, and improve healthcare for older Americans. Among its provisions: a cap on Medicare drug costs, which would reduce the cost of prescription drugs for seniors by nearly $2,000 a year, and the extension of expiring subsidies for Medicare prescription drugs. The bill would also increase corporate taxes, bringing in more than $300 billion to reduce the deficit.

Inflation Reduction Act savings are very tenuous. Almost all the savings would be wiped out by future spending increases and new initiatives, according to the Committee for a Responsible Federal Budget. The act would also extend subsidies for the Obamacare program, which will cost taxpayers half of the savings. The deficit reductions are thus only a temporary measure, and the tax policies will continue to pay dividends in the long run.

The Inflation Reduction Act would increase investments in energy efficiency and climate change proposals. It aims to reduce carbon emissions by 40 percent by 2030. The bill would also allow Medicare to negotiate with drugmakers over prescription prices. It would limit out-of-pocket drug costs for senior citizens to $2,000 a year. Inflation Reduction Act would also direct $80 billion to the IRS, aiming to hire more auditors, beef up customer service, and improve technology. The Act’s net impact would be statistically insignificant.

The Inflation Reduction Act would increase revenues by more than $300 billion over the next decade. The bill contains multiple provisions aimed at accomplishing the goal. Its effects on the deficit include curbing demand in the economy, while other measures would increase supply, which may reduce prices. This would also reduce the demand for resources, which could be a good thing. When these two factors are balanced, the United States would be more prosperous than ever.

The Inflation Reduction Act is a political signal than a fiscal one. The Democratic Party read the polls and saw that the top political concern of Americans is inflation. Because of this, they rebranded their latest piece of legislation as an attempt to tackle the problem. However, the Inflation Reduction Act does not remove the incentives for higher spending but raises political barriers to free-lunch fiscal policy.

- Also Read: Bigfitness Reviews Complete Details!

- Also Read: Bufote Reviews How to Find Trustworthy Bufote Reviews and Which Ones to Ignore?

- Also Read: BestDigitalProducts How to Create a Digital Product For Sale?

- Also Read: UFB Direct Reviews Complete Details!

- Also Read: Shopbeautydepot Reviews Is This Beauty and Cosmetics Store Worth Your Time?

The CBO scored the Inflation Reduction Act to lower the deficit by $305 billion over the next decade. The bill also includes over $100 billion in net scoreable savings and $200 billion in additional tax revenue from stronger tax compliance. It also includes prescription drug savings, which are significantly larger than new spending. The bill also imposes modest net spending cuts through 2031, reaching more than $40 billion in total by 2031.