In this article on Bonistas .com our perusers will get to be familiar with bonds and highlights of this site.

Do you have any idea what the word bonds implies? Do you comprehend the reason why we sell bonds? This site empowers you to trade various bonds online while being at home. Many individuals in Argentina have begun exchanging on the web through this official site.

If you enjoy gambling, you’ll find an online casino at Bonistas.com, which offers many different types of bonos, as well as graphic explanations of each. There are short-term and long-term bonos to choose from. In addition, you can also enjoy a live casino experience while playing fixed-bond games.

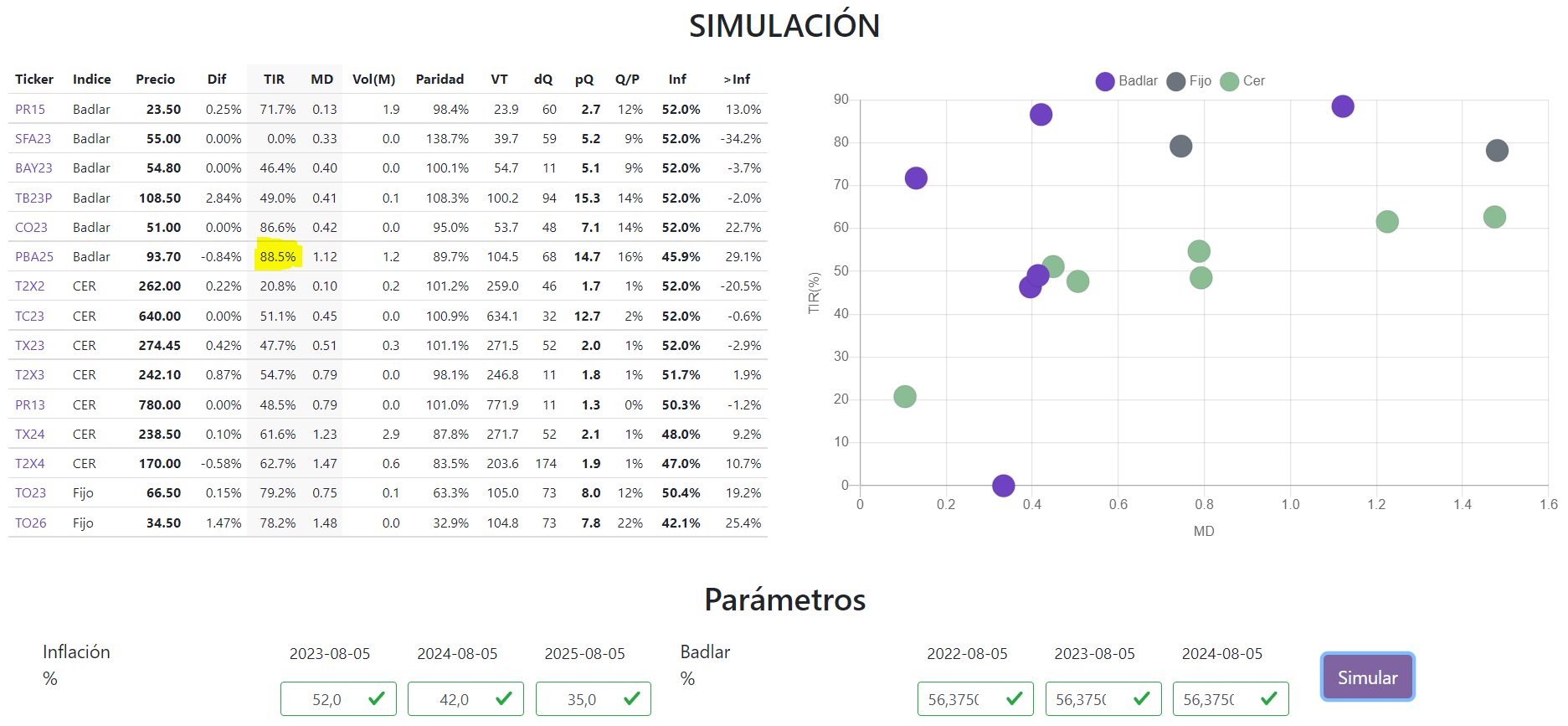

The site gives various bonds and gives charts and tables to portray each bond. Present moment and long haul bonds are the two kinds of bonds. In this article, you will find out about the Bonistas .com site. It will work with your buying choices and highlights of this site. Seek after perusing to find out about it.

Bonistas

If you’ve ever wanted to play casino games online, Bonistas.com might be the site for you. It’s an online site that lets you play games, and trade for different types of bonos. The website is easy to navigate and offers many different options for playing. Moreover, it offers a graphic representation of each different type of bono, so you’ll be able to easily figure out which bonos you’d like to play.

The website has a wealth of information about different types of bonds, and it offers nitty-gritty details about them. This information can help you make the right purchase decision. There are also graphs and charts that you can use to understand the different features of the various bonds. The site is also easy to navigate, which can make it a great place to start if you’re new to bonds.

The study also showed that bonistas of 15% or more achieved better academic rendiment than bonistas of 10% or less. The difference was statistically significant in the first and third semestres, as well as in the fourth and fifth semestres. This means that bonistas of 15% or more are more likely to excel in their studies.

Another important factor to consider when evaluating bonistas is their race and color. The study also included other variables, such as sex and marital status, in addition to the age and number of semesters at the UFMG. The study used several independent variables to assess the relationship between race and academic performance.

The bonos are also used as a means to finance the operations of companies. They attract inversors who help the businesses by investing their money. This helps in increasing the amount of money they raise. With the website, users can sell or buy funds. Bonos are generally fixed for a certain period of time. After that period, the funds are returned to the inversors.

Fixed bonds

Fixed bonds have a low-risk profile, and are a good investment option. These securities typically have a fixed maturity date and no minimum age requirement. The website also gives users detailed information about the bonds they offer. The website makes bond-buying an easy process, with graphs and tables that help them make informed decisions.

The site features several types of bonds, including fixed rate bonds and CER bonds. These are investment securities in which investors lend money to companies or governments and receive interest on the money. The website displays each bond graphically, and includes historical ratios that give a general overview of its performance. Information is also available on repayment plans, repayment schedules, and price trends.

Fixed bonds offer a fixed rate of interest over a set period. The interest is paid twice a year, and bondholders must hold them until the development date. Usually, the longer the fixed rate bond, the higher the interest rate. If you are looking for a long-term investment, you should consider buying a fixed-rate bond.

Fixed rate bonds offer an attractive interest rate and are an excellent option for those who are not comfortable with a fluctuating market. Fixed rate bonds have a lock-in period of between one and five years. Once the bond matures, investors receive the initial principal back from the issuer. In addition, interest payments are made semi-annually or annually. Fixed rate bonds are also a good choice for diversification in an investor’s portfolio. And unlike other types of investment, fixed-rate bonds offer the assurance of predictable interest and principal payments.

Fixed bond trading

Fixed bond trading is a way to invest money in a specific asset. These investments are generally fixed for a set period and pay interest to the financial backer. Fixed securities are available to a wide range of investors and offer many different options. The website offers nitty-gritty information about each bond, including graphs and charts. This site is easy to use and allows you to make informed decisions.

Fixed bonds are short-term investments issued by companies or governments. These investments are guaranteed by a certain interest rate and will usually pay out twice a year. The website displays the bonds in attractive graphs and lists every detail, including price and repayment schedules. There are also historical ratios that give an overview of how bonds have fared over time.

Bloomberg offers an online trading platform for fixed income securities. This fixed income platform enables users to execute trades in a variety of fixed income securities, including corporate and municipal bonds. It also offers straight-through processing and multi-dealer composite pricing. Additionally, users can monitor their trades in the Bloomberg Terminal and access a deep pool of liquidity with its TSOX blotter.

Fixed bond investing in Puerto Rico

The value of Puerto Rico municipal bonds plunged dramatically in 2013, as a result of Puerto Rico’s financial crisis and additional financial stressors. The island also suffered a major loss due to Hurricane Maria. Unfortunately, many investors overconcentrated in these bonds based on brokers’ promises.

As a result, investors should be very careful when investing in these bonds. The risk of losing their entire investment is high. However, you can protect yourself from such risks by doing your homework. There are several factors to consider when investing in these bonds. First of all, you should know that the bonds are segregated. This means that they must be owned by the corporation or by a fideicomiso or a bank in the United States.

Another consideration is the economic recovery of Puerto Rico. The government has recently approved a new fiscal blueprint that takes into account the efforts of the Biden administration and accounts for the government’s efforts to stabilize the island’s budget. This will help Puerto Rico avoid budget deficits until 2048.

The plan’s implementation, called the COFINA Plan, represents a critical step in Puerto Rico’s economic recovery. This plan will restructure COFINA debt under the PROMESA program, as well as cut back on costly litigation and accelerate the termination of the Oversight Board. These changes will help the island return to the financial markets and provide financial security to its residents. However, it’s important to know that the COFINA plan is not a perfect solution.

The proposed plan is based on a new fiscal plan that was approved by the Congress under PROMESA. The plan was approved under a new fiscal framework and is the means for Puerto Rico to regain fiscal responsibility and access to the capital markets. While Mr. Hein attempted to argue that these plans violate the Contracts Clause, the Court concluded that the plans were reasonable and necessary.

Do you know about this site?

The site offers you different sorts of securities, as fixed rate securities, CER securities, USD rewards, and link securities. Securities are speculation protections where financial backers advance cash to the public authority or organization for a restricted period and get revenue in return for their venture.

This site addresses securities through alluring and straightforward diagrams, and financial backers can put away their cash likewise. Each significant detail is referenced with the goal that financial backers can use sound judgment. Verifiable proportions are portrayed, which gives an outline of that specific bond.

More about Bonistas .com

To figure out bonds and to contribute carefully, this site has depicted bonds through Start, Simulation, Payment Schedule, and Bond Ratios. By and large, interest on bonds is paid two times per year.

Assuming the individual who claims the bond holds it till the development date, the financial backer will get the whole chief sum. Organizations and states fund-raise through these securities by financial backers.

For what reason is this news trending?

Securities are a method of interest where the two players benefit as the organization or government gets cash to subsidize their business. For the benefit of that, financial backers get intrigued, expanding their cash. On the site Bonistas .com, you can exchange your cash and procure benefit. Fixed securities are fixed for explicit periods, and the financial backer can get their cash back after the fulfillment of the periods. By and large, there are three kinds of securities: US Treasury, corporate and metropolitan.

End

We can say that it’s an extraordinary site to exchange your cash since it gives you different choices and nitty gritty data in regards to bonds and has an open structure they address through charts and graphs, which is straightforward.

- Also Read: Golden BC Accident Trans Canada Highway Closed Due to A Golden BC Accident!

- Also Read: Is My Derma Dream Legit? Authentic Review!

- Also Read: Moveruiz com Know The Complete Details!

- Also Read: Zambian Meat Website Know The Authentic Details!

- Also Read: Field BC Accident A Field BC Accident Leaves One Man Dead and Another With Serious Injuries!