This post uncover US land costs before very long. Assuming that you are keen on perusing the expectation, if it’s not too much trouble, read our Goldman Sachs Housing Market down.

The housing market is expected to rebound strongly in the near future, according to Goldman Sachs. The firm’s analysts have named several stocks to buy in the industry, including PulteGroup, Toll Brothers, and M.D.C. Holdings. All of these companies have price targets of at least $50.

Are you living on lease? Do you fantasy about possessing a house? If indeed, the new expectation to a land master will energize you to begin saving. The United States has explicit strategies with regards to business and local locations. Thus, the costs of such locales rely upon different elements. Individuals have confronted issues purchasing a house or void land in the previous years. Be that as it may, it will before long be done with Goldman Sachs Housing Market forecast. Mercifully read our post until the finish to get more familiar with it.

The Prediction/Report

A report named “The Housing Downturn: Even more to Fall” was distributed by Goldman Sachs investigators on Tuesday. As per the venture bank, there will be an overall log jam in the real estate market toward the finish of 2022. The organization expects critical drops in new house deals (- 22%), current home deals (17% decline), and lodging GDP (- 8.9% misfortune) this year. Albeit the Russian economy is wrecked, GDP is simply estimate to diminish by 3% this year.

Home sales have slumped in recent months

Goldman Sachs analysts recently warned their clients of a housing market slump. Rising mortgage rates and limited supply are slowing home price growth. The firm expects the slump will dampen the overall economy and rein in inflation. It’s also worried about the implications for future home prices.

The firm predicts that prices will continue to fall, though it will be slower than in the past few years. The rise in mortgage rates is pushing some buyers away from the market, which is already overheated. As a result, new home sales are expected to fall further in the coming months.

A housing market slump typically results from a slowdown of around 10% in house sales. While this may seem modest on its own, the overall housing picture shows a huge change. Home sales in the UK, Canada, and U.S. have dropped by at least 40% from their peak during the pandemic. And since housing prices are linked to mortgage rates, a decline of 10% in house sales is likely to have a major impact on prices in the near future. Historically, a 10% slowdown in house sales tends to be followed by a 2 percentage point drop in house prices in about 6 months.

While Goldman Sachs was the king of Wall Street, the firm has been facing legal action in the U.S. over a mortgage deal it made. A civil lawsuit filed by the Securities and Exchange Commission alleges that the firm sold mortgage investments intended to fail. The lawsuit has been the first of its kind to hit the big Wall Street firms. The lawsuit names Goldman vice president Fabrice Tourre as the defendant.

Home prices are cooling off in some markets

The US housing market is cooling down, according to Goldman Sachs. The forecasts indicate a gradual slowdown in home prices, though they are not expected to drop dramatically. Rising interest rates have made homes less affordable, according to the research firm. The Federal Reserve has barely increased interest rates this year, which is pushing up bond yields and increasing mortgage costs. The analysts predict that home affordability will continue to decrease as more people can’t afford the rising costs of mortgages.

This is reflected in the Goldman Sachs Housing Affordability Index, which measures the financial burden of mortgage loans. Despite recent increases in the index, affordability is still low in many markets, particularly in the U.S. and Canada. While many consumers are still hopeful about the future of home ownership, many buyers are losing confidence and are letting deals fall through.

While home prices have risen over the past few years, the US housing market is now cooling off in some markets, with less demand and higher mortgage costs. The company’s forecasts suggest that home prices will fall more in the second half of this year. The analysts also note that while home prices are still rising, the price of homes is declining more quickly than the rate at which they were rising last year.

However, these changes are not enough to alleviate the housing shortage. For now, nationwide changes seem unlikely. The changes are more likely to be local or state-based, which is only a partial step.

Home sales will bounce back in 2019

There has been an outsized housing boom in the U.S. in the past few years. This era was characterized by high home prices and low inventory. While many housing market analysts have predicted a rebound, Goldman Sachs economists argue against this. They say that the tight housing market and rapid deterioration in affordability will dampen the impact of higher interest rates.

According to the bank, prices will rise only modestly in the next few years, with price growth remaining modest. This is good news for home buyers. Rising wages should help spur demand for lower-priced homes. Meanwhile, increased supply will help stabilize housing prices. With a tight labor market, buyers can expect to find it easier to purchase a home. In addition, more people are working from home, which helps alleviate the pressure on prices.

Despite these signs, the housing market remains tough for buyers. The price increases are steeper than they were a year ago, and competition for desirable properties is fierce. Buyers are also paying premiums for properties. The 10-city composite index is up nearly 20% year-over-year, while the 20-city composite index is up 21.2%. This shows that smaller markets tend to see more price increases. This means buyers are flocking to those regions where prices are more affordable.

Rising interest rates are another concern. In the U.S., the most commonly used mortgage rate, HIBOR, is expected to rise by around 270 basis points through 2024. By 2024, the average HIBOR will reach 3.8%, up from just over one percent in the fourth quarter of last year. This increase could lower the value of a home, which could cause a price decline.

Home prices will grow less quickly in 2024

The latest Goldman Sachs forecast shows that the housing market is beginning to cool after the craze that was felt over the last year. In both the U.S. and the U.K., home sales have fallen dramatically in recent months, and the company is warning that the market will grow less quickly over the next two years. The firm expects home prices to increase by about three percent a year in 2024, a significant decline from the 7% growth seen earlier this year.

The Goldman Sachs economist says that there is still a long way to go to fully recover the housing market. He believes that the housing market will be at a much lower level by 2024 than in 2006. In fact, the housing market has already fallen 30% from its peak. Meanwhile, mortgage rates are still quite high, having dropped as low as 3.2% last January. In addition, the report notes that house sales and permits have fallen in most regions of the U.S., compared to the period before the pandemic.

Despite the forecast, the overall house prices are still rising in Germany, the U.S., Australia, and Sweden. However, in New Zealand, house prices have fallen most. New Zealand home prices are now 8% below their peak during the pandemic. The report says that prices will fall by at least 10% in Canada, 9% in France, and three percent in the U.S. in the next two years. According to the report, this slowdown is due to weak momentum in the past two years, as well as rapid policy hikes by the Bank of Canada.

Goldman Sachs’ forecast

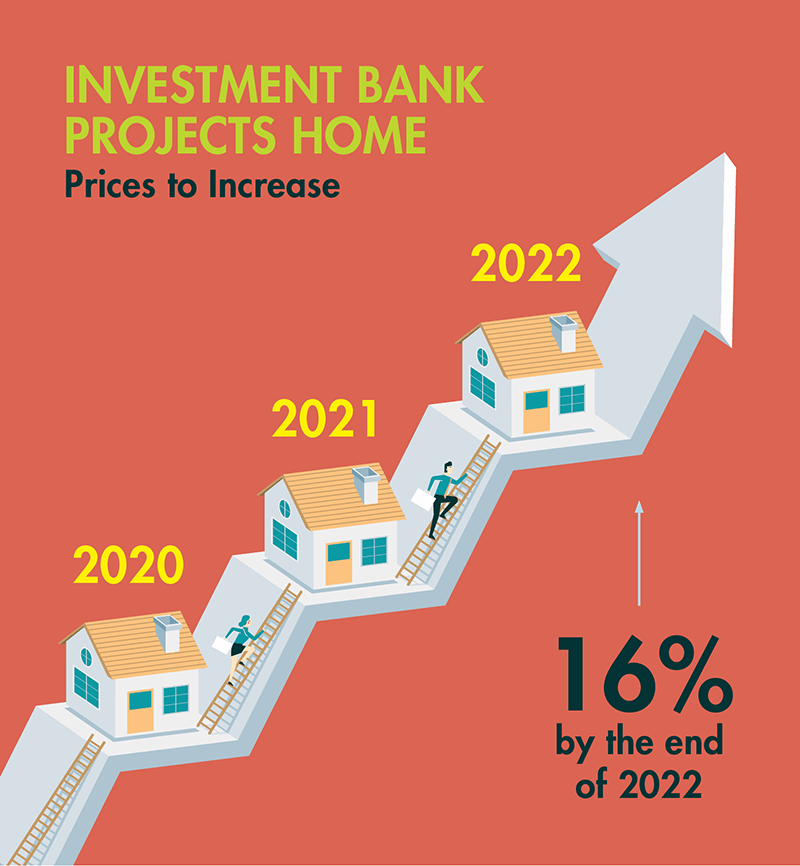

The housing market has already gotten more expensive than it was a few years ago, with prices rising sky high. The Goldman Sachs model looked at home prices and affordability, and found that home prices will continue to rise. The tight housing market and strong demand will gradually lead to less affordable homes, while increasing supply will result in more inventory on the market. This is why the Goldman Sachs housing market forecast calls for home prices to rise by 16% in the coming year. At the same time, rents will continue to rise. The housing shortage could persist for a while longer, unless regulatory efforts are implemented to alleviate it.

The housing market is a critical part of the economy. And when the housing market is weak, the rest of the economy suffers. That’s what happened in 2008, when the housing market crashed. While Goldman Sachs’ housing market forecast is far from definitive, it should give investors pause.

The report also notes that home sales have decreased in some areas, and building permits have declined more than in others. This may reflect a sustained decrease in affordability and a recent decline in purchasing intentions.

Hatzius’ two calls on the housing market

Unlike the financial markets, the housing market remains relatively stable and homeowners hold onto their properties even during bear markets. Many of them are even prepared to wait for the market to recover, especially in areas such as the Southwest and coasts. But Hatzius expects the correction to be painful, particularly in areas with exotic mortgages that allowed homeowners to borrow against their homes for higher amounts.

In a recent note, Goldman Sachs Chief Economist Jan Hatzius asserted that there’s more downward pressure ahead in the housing market. In his note titled, “The Housing Downturn Continues to Worry,” Hatzius offered two predictions for the housing market in the years to come. According to Hatzius, a housing bubble begins when demand for homes is high and inventory is low. When the demand for homes decreases and supply increases, the prices of homes can fall dramatically.

Goldman Sachs Housing Market

The United States real estate market had its most memorable decay since the Great Depression. The year 2023 will not give any respite, by the same token. Goldman Sachs anticipates that new house deals should fall by 8%, existing home deals to fall by 14%, and lodging GDP to fall by 9.2% in the following year. Just on the horizon is the absolute worst result.

The Inflation Effect

The Federal Reserve’s endeavors to diminish expansion have inescapably added to the ongoing real estate market droop. The property market drooped not long after the save bank fired pushing up contract rates this spring. Many individuals and Goldman Sachs Housing Market quit searching for another houses all over the United States. The Federal Reserve accepts that a decrease in the real estate market will affect the economy, easing back development and assisting with reigning in expansion.

The decrease in the real estate market may likewise be ascribed to the ascent in the quantity of families. An extraordinary expansion in family arrangement came about because of the pandemic and the Work From Home upset it started. Might you at any point fault recent college grads for not having any desire to impart a work space to their kid? Goldman Sachs Housing Market, nonetheless, claims that this pattern has finished.

The Result

As per Goldman Sachs, the real estate market will wind up in a very difficult situation at some point in 2019. The venture bank predicts that the property market will recuperate in 2024. Goldman Sachs gauges that this will prompt a yearly ascent of 3.5% and 3.8% in 2024 and 2025, separately.

End

The US housing market isn’t hard to examine on the off chance that you realize the including home subjects. We have placed Goldman’s whole expectation in this article. According to our exploration, the expansion rate, development time, pandemic, and different elements assume a part in the Goldman Sachs Housing Market study.

- Also Read: Zambian Meat Website Know The Authentic Details!

- Also Read: Is My Derma Dream Legit? Authentic Review!

- Also Read: Whole Beast Protein Review Is It Legit?

- Also Read: Kbm 25 Com Know The Latest Authentic Details!

- Also Read: Golden BC Accident Trans Canada Highway Closed Due to A Golden BC Accident!