This article will give you well-informed subtleties on Fedloan Reviews. Compassionately visit the whole article to know more subtleties.

When it comes to repaying your federal student loan, there are many options available. You can contact a company that specializes in student loans to help you figure out the best course of action. You can also contact a financial aid officer to get information about repayment strategies. Fedloan Reviews is a service that helps you navigate the world of federal student loans. Founded in 2009, the site has a 99% trust rating and offers resources for both students and financial aid officers.

About Fedloan

According to our research, we discovered a few positive and negative reactions, for example, client surveys. We found that the association gives long reimbursement plan terms, simple installment modes, and great client care.

Negative surveys, a higher loan fee, and trouble in getting data. The association has 4.5 evaluations on dating destinations. Fedloan is a stage that gives credits to understudies. The association was made by PHEAA in 1963. Many individuals have involved this stage for getting advances and have various considerations about it.

So we tracked down blended audits of this specialist organization. Further, you will find out about Fedloan.

Fedloan Reviews

In the above segment, we have shared the surveys of Fedloan. The association gives two sorts of educational loans:

Family Federal education loan: In this sort of advance, the Schooling US division offers to purchase from third-group moneylenders.

Direct loan: These credits don’t look for help from banks of the outsider. Rather than this, the US office straightforwardly gives them.

The association gives assets to the monetary guide officials at Colleges and universities as well as understudies. The credit is for understudies’ monetary help, and they can reimburse it later. The site offers to make your reimbursement technique according to Fedloan Reviews.

Customer service

FedLoan Servicing offers customers the opportunity to change the due date on their loan account. However, it is important to note that you must make your first payment to change your due date. In addition, it may take up to two billing cycles for the new due date to be reflected on your account. It is also important to note that if you have a paid-ahead status on your account, it will be removed once you make two payments within the same billing cycle.

If you are unhappy with the service provided by FedLoan Servicing, you may contact the Consumer Financial Protection Bureau to complain. You can find the correct contact details for your state by visiting their website. The company also has various postal addresses that you can use to contact the company. You can visit their website to learn more about their mailing addresses.

FedLoan customer service representatives are known for being inconsistent and unhelpful. For example, there are reports that some customers were misinformed about how to apply payments to their loans. As a result, they were forced to make bigger payments than they could afford. In addition, FedLoan customers complained that their payments were not processed correctly and didn’t apply to their loans.

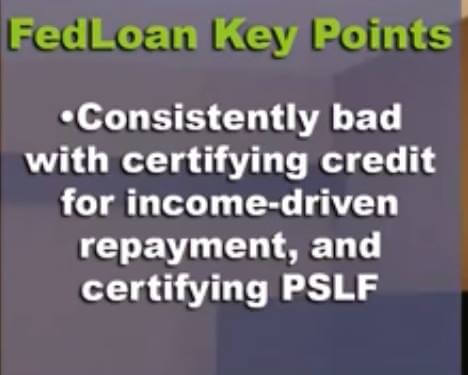

FedLoan has faced numerous controversies over the past several years. In 2018, for example, the servicer mismanaged the PSLF program and failed to inform affected borrowers about their rights to appeal mistakes. Furthermore, it converted thousands of TEACH grants to loans, resulting in clerical errors and minor delays. These controversies forced the company to settle the case in February 2021.

Billing

FedLoan offers a mobile app for customers to repay their loans. They also offer flexibility in repayment methods like checks and money orders. If a customer is having trouble with their payments, they can enroll in a third-party service to make the payments for them. Customers who are unhappy with the service can leave the company at any time.

FedLoan offers several payment options including income-driven repayment plans, which help borrowers who are unable to make their payments. However, customers have reported a number of problems with their payments. In some cases, customer service representatives provided incorrect information about repayment options. Others reported that they were not able to make their payments, or that they were required to make payments of greater amounts than their payments should be.

Collections

If you’ve received an email from FedLoan Collections, you may be wondering how to respond. This is a common question, but there are some things that you can do to protect yourself. First, it’s important to know the law regarding the debt validation process. The validation process requires that you verify your debt with your state’s attorney general office. You should request a debt validation request within 30 days of being contacted by FedLoan Servicing. The validation process will stop the debt collector from collecting your debt during this time period.

FedLoan Servicing is a company that collects federal student loans. They contact debtors when they’re behind on payments. They also appear on credit reports. You should be wary of debt collection calls from this company because they’ll only make matters worse. To avoid this, you should learn your rights under the Fair Debt Collection Practices Act (FDCPA) before you speak with them.

If you are a government or nonprofit employee, you can apply for Public Service Loan Forgiveness. After qualifying for the program, you can have your debt forgiven if you work for 10 years for a qualifying organization. The process is easy and fast. If you qualify, you’ll receive a welcome notice from FedLoan and MOHELA. Afterwards, you’ll be able to access your full account details.

Misinformation

Fedloan reviews often contain misinformation, which is detrimental to consumers. Consumers must be aware that there are various payment plans available, and it is vital to understand each one. Despite their various benefits, these plans are not suitable for everyone. For instance, the interest rate charged on student loans may not be affordable for those on a low income. Fortunately, there are ways to make your payments more affordable based on your income.

Those who use Fedloan should call to verify if they are getting the right loan, or if their application is being processed incorrectly. This is especially important if they have a public service loan, or if they have decided to consolidate their debt. In addition, customers should be aware that misinformation in Fedloan reviews may lead them to incur higher debt than they planned.

Follow-through

FedLoan offers a wide range of student loan repayment plans, including income-driven repayment plans, which borrowers can use if they are struggling to make their payments. However, many consumers have experienced difficulties with the service, and there are numerous Fedloan Reviews that highlight the company’s lack of follow-through. The company’s customer service representatives are frequently prone to giving incorrect information and botching plans requests. As a result, borrowers often end up having to make larger payments than they could afford.

Is Fedloan genuine?

Authenticity can not entirely set in stone by trust score. The trust score on this site is close to 100%. The site was enlisted on 6 May 2009. Clients are the huge observer that can determine if the site is genuine or a trick. We have discovered a few surveys and imparted them to you in the above segments.

According to the audits, the site looks protected. There are numerous positive audits, yet a few negative surveys are irritating us. However, generally the site appears to be real. The site of Fedloan administration is all around kept up with and appears to be encouraging.

Fedloan Surveys were tracked down on different web-based locales, and they additionally got appraisals. We will advise you when we track down additional audits about this association.

Summary

In finishing up this article, we have furnished you with insights regarding Fedloan. Fedloan is a stage where you can get understudy loans. The future of this site is 13 years and the trust score is almost 100%. So according to these elements, we can consider the site genuine. We have explored the site and given you surveys. In the event that you find the audits pertinent, you can arrive at this site.

- Also Read: Kbm 25 Com Know The Latest Authentic Details!

- Also Read: Is My Derma Dream Legit? Authentic Review!

- Also Read: Price In India Emo Robot What Is The Cost?

- Also Read: Mbc222 Enter the First Site Know The Complete Details!

- Also Read: Is Discount Mall Legit Quick Website Review!