Try not to succumb to the IRS Text Scam messages. To be aware of this trick exhaustively, if it’s not too much trouble, go through the article and remain tuned with us.

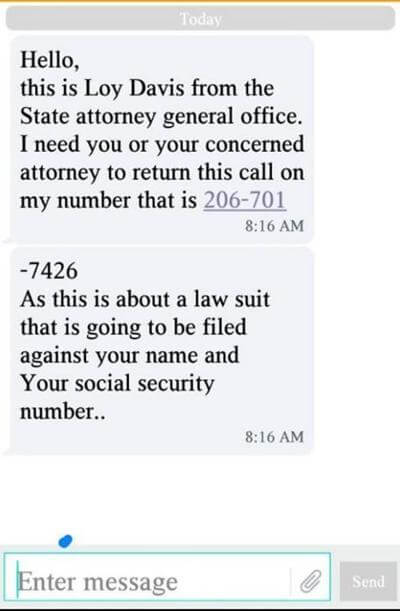

Have you confronted any web tricks previously? Do you have any idea what an IRS instant message trick is? In the event that not, then you ought to follow the full article. Numerous locals of the United States gripe that they get instant messages from the Internal Revenue Service. They referenced that the Internal Revenue Service requested their own data through that instant message.

It is very important to remember that the Internal Revenue Service will never contact you via text message or social media. They will never ask for personal information or financial information. They will not call you on the phone or email, either. That’s why you must avoid fake IRS texts at all costs. Here are some tips to keep yourself safe from these scams:

These days, it’s become normal to get such trick messages where the source requests individual subtleties. In any case, did the IRS send this kind of message? Keep on perusing the IRS Text Scam article.

HSPD-12

The IRS does not initiate contact via text messages. When you receive a phone call or text message, they should never ask for your credit or debit card number. If you receive an unexpected text message, you can check to see if the representative is legitimate by calling the IRS. If the person is asking for money, they should be able to produce a HSPD-12 card (government-issued photo ID card) and ask you to verify the information on the card.

A HSPD-12 card is a government-issued identification card that identifies federal employees. In addition to its identification benefits, this card will prevent identity theft and fraud. Besides, the HSPD-12 credential is also accepted at many businesses and government facilities. The HSPD-12 card is also the standard form of identification for federal employees.

In addition to HSPD-12 cards, IRS agents do not ask for your credit card number over the phone. They will also never threaten you with arrest or revoke your business license. Taxpayers should also be aware that the IRS cannot revoke their immigration status or revoke their licenses if they do not pay their debt. They have the right to dispute the debt they owe the IRS.

While the IRS has taken steps to prevent these scams, they cannot completely eliminate them. Fraudsters are increasingly using new technologies to target taxpayers. They are now using social media and text messages. Some even use phishing emails. One new email scam involves impersonating executives and spoofing their email account. The scammers then use this information to steal their identities. Oftentimes, the personal information is used to make illegal wire transfers.

This scam is designed to target tax professionals. They impersonate tax software providers and send fake emails claiming to be from the Internal Revenue Service (IRS). They claim they have an urgent task that requires updating the tax preparer’s account with the tax agency. The emails link to phishing websites where they collect tax professionals’ login credentials. They then demand payment via a specific method. They may even use this information to file fraudulent tax returns.

The IRS warns taxpayers to not respond to these unsolicited messages. The fake texts may contain bogus links to websites that look like the IRS. You should not respond to these scam messages and never click on links in the e-mails or texts. Instead, contact the contact directly to confirm the information they sent you.

If the caller claims to be an IRS agent, they will introduce themselves by name. A legitimate revenue agent will never ask for immediate payment, and the phone call will be an actual person – not a prerecorded voice. Be sure to ask to see their credentials before giving them your financial information. You should also demand to see their HSPD-12 card. These cards are issued by the government as government-issued identification for federal employees.

In some cases, a scammer will pretend to be the Federal Deposit Insurance Corporation (FDIC). This organization never asks for banking or personal information over the phone. It is also important to note that the IRS never sends transcripts via email. If you do receive an email claiming to be from the IRS, you should request a copy directly from the IRS. If you receive an email asking you to provide personal information over the phone, this is an IRS scam.

To avoid this scam, it is important to check the caller’s identity. If you don’t recognize the caller, ask for their full name. If you are uncertain about the identity of the caller, you can try calling the treasury inspector general for tax administration to confirm their claim.

Another common scam involves an IRS email. The sender of this email may use an IRS logo to trick the recipient into clicking on a link to a fake IRS website. Using this fake website will expose your computer to malware. You should never submit any tax form to an IRS email address. You should also make sure that the company is not trying to make a profit from you.

HSPD-12 card

If you’ve received a text message from an IRS representative asking for credit or debit card information, you should be on the lookout for this type of IRS scam. The IRS will never contact you over the phone, or ask for your credit or debit card information over the Internet. They will also never demand you pay money over the phone, or threaten you in any way. Remember, the IRS has a Taxpayer Bill of Rights, and they aren’t allowed to threaten you or ask for money from you.

If you are the victim of this scam, your best bet is to freeze your credit and file a fraud alert with the appropriate agencies. In addition, you should ask the IRS representative for identification, such as an HSPD-12 card, which is the standard federal identification card carried by federal employees. The IRS will also provide you with a dedicated phone number to contact if you have questions. Don’t give out your social security number or other personal information to this IRS representative.

IRS revenue agents may visit you during an audit. If you received an audit notice, you should have scheduled an appointment with the revenue agent. The revenue agent may call or send you a letter that confirms your appointment. However, if you have no idea who the IRS representative is, ask for credentials. IRS representatives usually carry two forms of official identification: an HSPD-12 card and a pocket commission.

The IRS will never contact you through text message without verifying your identity. A representative will never ask you to pay money in advance without verifying your credentials. They will provide you with an HSPD-12 card and a dedicated phone number to verify the details on the card. Unlike other companies that send you a text message asking for money, the IRS will never ask for money, so don’t be fooled by their scams.

The IRS doesn’t use email to communicate with taxpayers, and it doesn’t use social media to communicate with them. Therefore, you should never respond to social media requests and never click on links sent by scammers. This is another reason why you should always verify the identity of any person you meet on social media before giving out any information.

About IRS Text Message Scam

As per the citizens of the US, they got an instant message from the IRS, where the Internal Revenue Service requested the citizens’ very own data. Sending this kind of phony instant message is known as smishing. Presently you should need to know what smishing is.

All things considered, smishing is very much like phishing. In phishing tricks, programmers email counterfeit connections. What’s more, in a smishing trick, programmers make counterfeit messages from government offices, confided in organizations, and noble cause. The best instance of smishing is the IRS Text Scam. Kindly continue to peruse the article.

How to recognize in the event that it’s a scam text or not?

Assuming you are a citizen of the US, you ought to constantly recollect that the Internal Revenue Service won’t ever reach you by means of instant messages or online entertainment. Furthermore, they won’t ever request your own subtleties or monetary subtleties. The Internal Revenue Service likewise won’t reach you by means of email or telephone.

You need to recollect these things prior to making any stride. It’s your obligation to disregard such phony instant messages. We can’t prevent programmers from sending such IRS Text Scam messages, however we can be more cautious with that.

You need to recall another thing on the off chance that the Internal Revenue Service needs to reach you, they will essentially send you a letter via the post office. The IRS will constantly send you the mail through the U.S. Postal Service. In the event that you get any instant message from the IRS, consistently recollect the realities referenced previously. Programmers utilize counterfeit site names and phony URLs to send these trick messages. These trick instant messages might look genuine, yet they are phony.

What to do on the off chance that you get an IRS Text Scam message?

Assuming that the phony instant message contains any connection, don’t open it. There might be a contact number in the instant message. Try not to call that contact number. You should disregarded such phony instant messages. Assuming you click on the connection or call the contact number accidentally, the programmers will hack all your own and monetary subtleties. The tricksters can likewise stack malware on your gadget. Try not to succumb to such phony messages.

Summary

That is all there is to it for the present article. In any case, you can tap on the connection to get more data about the phony instant message trick:. Also, assuming you get the IRS Text Scam message, overlook it, or you can report such phony messages to true mail. We trust this article will be useful for you.

- Also Read: Golden BC Accident Trans Canada Highway Closed Due to A Golden BC Accident!

- Also Read: Is My Derma Dream Legit? Authentic Review!

- Also Read: Zambian Meat Website Know The Authentic Details!